Helmets On! It’s Launch Time for Prime3G!

We just raised 400Cr ($60M) in Fund 3 — and our “startup partnership” journey continues to delight & amaze!

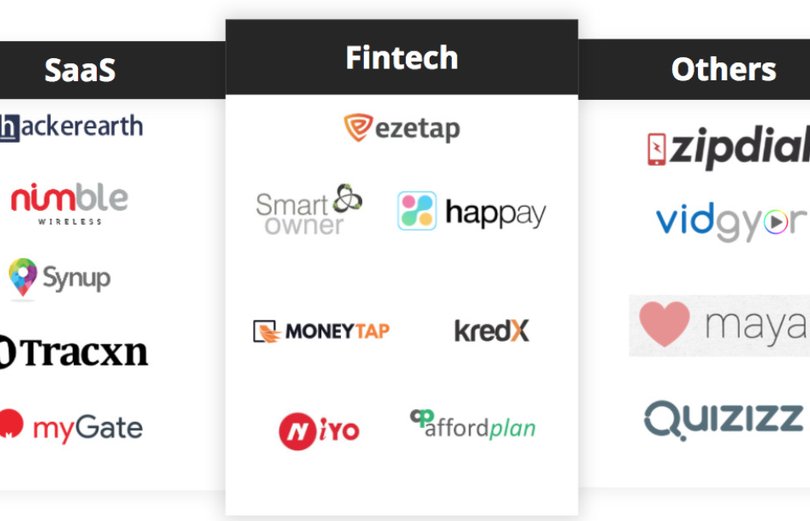

We just announced the launch of Fund 3 at Prime Venture Partners — we raised $60M which is a nice follow-up to Fund 2 which was at $46M & Fund 1 at $8M. Our model of deep conviction and high support has been our calling card and appears to be working well! We are thrilled to be associated with each and every one of our 18 astounding companies and the close to 40 SuperStar founders we are privileged to work with! Our companies include:

- Fintech & Financial Services - Ezetap (2010 — enterprise payments), SmartOwner (2012 — Real-Estate Financial Services), Happay (2015-Business Expense Management), Moneytap (2015 — App based consumer credit line), NiYO (2015-Digital Banking), AffordPlan (2016 — HealthCare Financial Services),

- SaaS & Enterprise Solutions - HackerEarth (2014 — innovation management platform), Synup (2015 — digital marketing solutions), Tracxn (2016-Bloomberg for Private Companies), Vidgyor (2015-video advertising), Nimble Wireless (2015-iOT, food, pet and drug safety), myGate (2017 — Gated Community Security).

- HealthCare, Education and Others - AffordPlan (2016 — at intersection of Fintech and Healthcare), Maya(2016 — Women’s reproductive health), Quizizz (2015-quizzing).

Each of our companies are led by amazing founders with audacious goals — and more importantly down-to-earth, practical minds that are cognisant of the realities and sacrifices they have to put in to get from here to those goals!

People always ask me — as a former entrepreneur, now that you’ve crossed over to the dark-side, how is life as a VC? My answer is always the same “I’m an entrepreneur, and Prime is OUR startup!” Having said that life as a VC is really quite fascinating!

As a VC, you have an opportunity to play teammate, coach, advisor, mentor, adult supervisor and many other roles. When you have a portfolio, you get to play all roles in a day — but most of all, we have to trust, respect and celebrate the mission that all good entrepreneurs have, “making the world a better place for others”!

In our case, we’ve tried to apply basic principles of fairness, transparency and common sense — reminding me of my dad’s advice “common sense isn’t common” — in everything we do; whether it is within our team, with our investors, with prospective entrepreneurs and of course with our portfolio companies. Below are key takeaways that have emerged as guides/learnings in our journey as a young, scratchy startup of “accidental VCs”.

- Respect the Uniqueness — everything about every business is different — teams & team gaps, metrics they need to track, capital requirements, revenue ramp-up, etc. — it is crucial to be able to spend time to understand the goals and requirements of the business rather than fitting them into some “magic-formula”. Not every company will become an operating system for their domain, or the X of India or the Uber of Y. The more we spend time understanding the nuances of a business, the more we’re likely to be able to advise founders in a manner that can guide them to the right outcomes.

- Partner time is for Founders — being an entrepreneur is very lonely — especially if you are a single-founder. More days will go bad than good and while you need to put up a brave face to your team, you need to confide in someone — and more often than not, that’s the most value we can provide to the founders. Listening, understanding, coaching, guiding and every now and then, some slightly strongly-worded constructive feedback. For this, in early-stage companies, founders need to speak with partners and we need to make the time for them whenever they need us.

- Our extended TEAM is as important to our Founding teams Not just partners, but OUR entire team has got to be there for founders — and have got to believe in their dreams if we are going to succeed, its not just about the partnership. In a small firm, every member of the team has to have the right attitude and needs to contribute to making the environment more fun than fun — and open, non-hierarchical inter-team communication is absolutely essential! If you’re enjoying what you’re doing, you hardly notice the time go by — this golden piece of advice applies to everything in life; we try and make sure that work should be more fun than fun — that draws the best performance from everyone!

- If you aren’t close enough, you can’t add value - I often find myself being very silent in board meetings — frankly I NEVER want to learn anything new (unless its good news) in a board meeting. The more context we have, and the more transparent founders are with us, the more we are in a position to help. I’m often amazed at how much secrecy founders think they need to keep from their investors — we’ve always felt more is less, and if you can’t trust your investors, who would you trust?

- Listen, Discuss, Dispute, Disagree, Debate — but never Decide — This is one of the biggest lessons I’ve learnt over the past six-years. Its important both for us and founders we work with should have the ability to listen and debate and be open to ideas — but as a VC, we have to leave all decisions to the management team. Ultimately we are co-passengers in the journey — and cannot and should attempt to be the drivers.

- Direct & Honest Feedback is most respectful — Founders have no time to waste, nor do we. If we aren’t interested, we try and tell them quick — sometimes in the first meeting itself. If we are interested, we try and move swiftly. Often we do need to see a few things develop — but we are the first to tell founders that and are always happy to meet from time to time to review and brainstorm with them.

- NO to CopyCats: Building conviction in something that has been proven is easy — doing so in something that nobody else has done is difficult — or so some say. Amazingly we’re finding that it’s easier to build conviction when its category-creating — rather than a copycat — because we evaluate each opportunity from first principles, not what others think or thought. After all, why risk failing at something that others have already succeeded at!!

- Use the Product: As A VC partnership we strive to get every opportunity to use our portfolio company products — and for b2b products, try and encourage our portfolio companies to at least consider each others products. Using the product from the first meeting helps us better judge the company too — attention to detail, customer care, imagining the possibilities, etc. Even before we become shareholders and advisors/board members, we NEED to become customers!

- 100% Conviction — or nothing — only back an entrepreneur and a startup when you have 100% conviction and that means you’re ALL in. There are no half-measures — you either believe in the entrepreneur and the business and invest for Plan A, or you don’t. This also means we bring our entire army to bear — all companies can reach out directly to the entire partnership, and all companies get to meet with all partners frequently to get multiple points of view.

- When convinced, move fast — Where things are reasonably well defined, and proven, while we are still very thorough with our diligence, we try and do it efficiently and quickly. When you get a meeting with us, it’s always directly with a partner who is part of the investment decision making team! We always strive to give direct constructive feedback — whether or not we invest.

- Less is More — as a direct outcome of doing the above points well, it is critical to have a smaller portfolio — one where we are primarily working with 3–5 early-stage companies at any point in time. Fund 1 had 7 companies, Fund 2 has 10, and Fund 3 will probably have 12–14. Some say this is too concentrated and we need to take more shots on goal — we believe its the other way around and whether we’re right or wrong, time will tell — but we must have 100% conviction in our approach!

- Stay Humble & Stay Hungry: Startups are successful largely because of the entrepreneurs and they are the stars in this movie — but having a strong supporting cast helps, and we’re happy to play that role. Our involvement is neither necessary nor a guarantee of success — and we’re always grateful that founders choose to work with us.

Above all, our VC fund is OUR Startup and we are Entrepreneurs too!

We have always tried to do things differently — and the idea of a One-Of-A-Kind Category-Creating business applies not just to our portfolio, but to our Venture Capital Fund too! We need to be frugal, be metrics driven, build a strong (nay the best!) team and build the institution over several years, there is no magic formula — you simply can’t run a marathon in 10 seconds!

One amazing bonus that we’ve come to experience is that we have learnt SO MUCH from the entrepreneurs we meet as well as the entrepreneurs we get to work with. Another lovely surprise was the camaraderie between founders — the sense of being part of a family and having peers to talk to and wanting to help each other is truly heart-warming. Our founders day is a simple event— we get founders to share their experiences with each other — and do something fun and unique, but not necessarily extravagant.

With Fund 3 we plan to continue on a similar path of focusing on first principles and building companies with star founders. Our focus areas will continue to be areas we understand well — mostly as an outcome of our working closely with the amazing companies below, many of which we first-started working with in the paper napkin stage.

We’re eager to join your exciting startup journeys & have you join us in ours! Connect with us and strap your helmets for an exciting journey — we have!!

Amit Somani, Sanjay Swamy, Shripati Acharya & the PrimeVP Team!

About the Author -

Sanjay Swamy is an Entrepreneur & Early-Stage Fintech Investor! #DigitalPayments & #Financial Services Fanatic! #IndiaStack_Evangelist!

This article was originally published on Linkedin

Recommended articles

View AllAadhaar - Tokenization puts to bed any concern of Centrally-Linkable Repository!

- Link Aadhaar to PAN card

- Link Aadhaar to school

- Link Aadhaar to Real-Estate

- Link Aadhaar to Mobile

- Link Aadhaar to …

Aadhaar - Face Authentication, not Face Recognition!

Just read about the Aadhaar-based face authentication (i.e. VERIFICATION) and saw several Tweets already on the topic. After reading all …

Read MoreIf you believe you are building the next big thing, let’s make it happen.